Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Investment Services, Annuities

Brandon Libunao

Libunao Ins and Fin Svcs Inc

Office Hours

After Hours by Appointment

Address

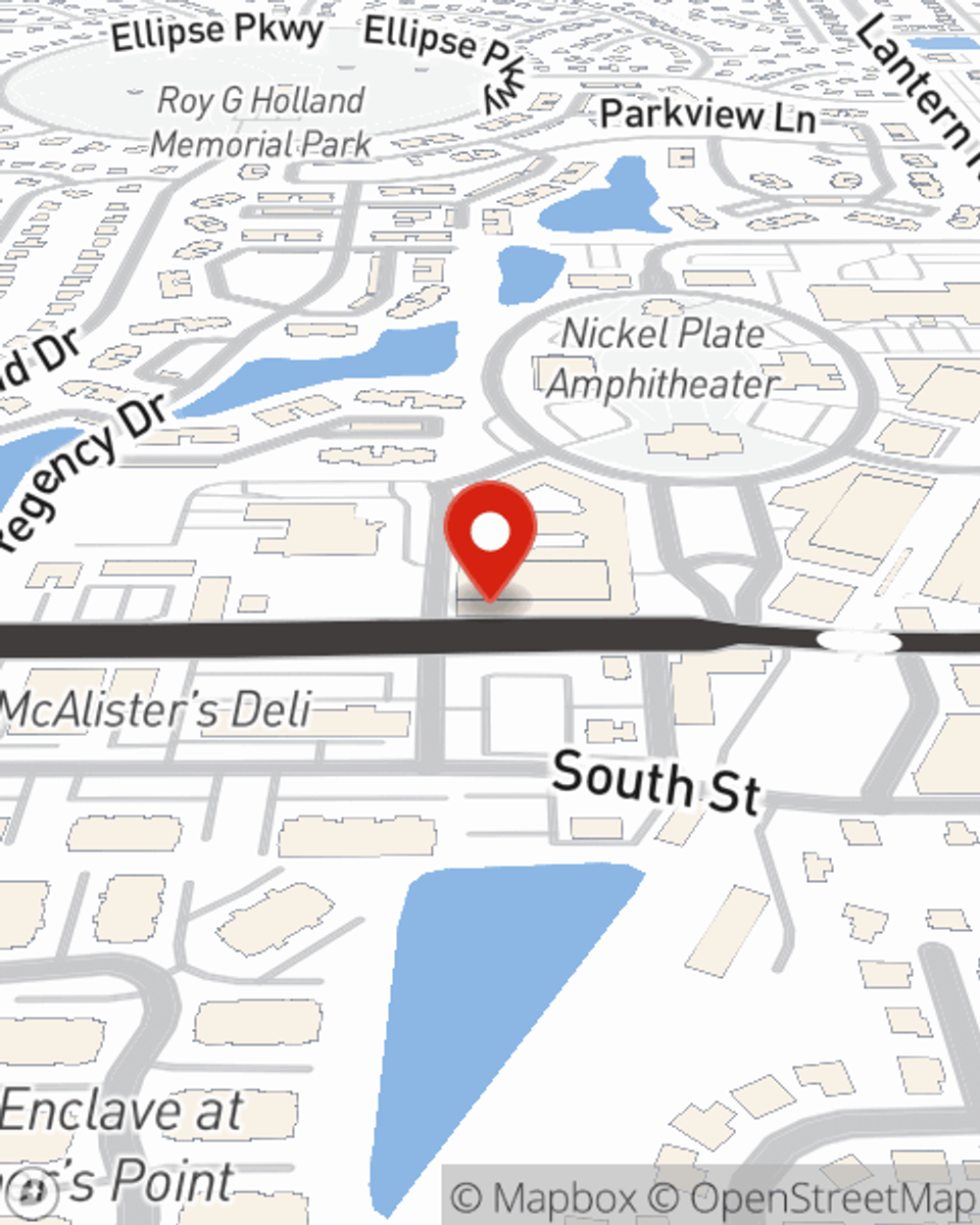

Fishers, IN 46038-1566

Right off of I-69N and 116th st exit.

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Office Info

Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Location Details

- Parking: Behind the building

-

Phone

(317) 849-1942 -

Toll Free

(833) 369-4573

Languages

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Investment Services, Annuities

Office Info

Office Info

Office Hours

After Hours by Appointment

Contact me to schedule a virtual meeting

Location Details

- Parking: Behind the building

-

Phone

(317) 849-1942 -

Toll Free

(833) 369-4573

Languages

Simple Insights®

Are your investments really paying off?

Are your investments really paying off?

Use this calculator to compare the rate of return on your investments and see if your investment savings are helping you to meet your financial goals.

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

What is first party medical and PIP coverage?

What is first party medical and PIP coverage?

Personal Injury Protection (PIP) pays the reasonable and necessary medical expenses you and your passengers incur after an accident, regardless of fault.

Viewing team member 1 of 11

Lindsey Libunao

License #1041744

Hello, I'm Lindsey Libunao. I am the Chief Operating Officer, licensed in IN, OH and IL. I have 11 years of experience in Property and Casualty and Life and Health coverage. In my free time, I enjoy traveling, shopping and true crime! When I'm not assisting our valued customers at our office, I cherish spending quality time with my family and friends. Visit our insurance office today for a free quote. I'm here to help you find the right coverage!

Viewing team member 2 of 11

Joseph Szumski

Team Leader

License #3748520

Hello! I'm Joseph, the Manager for the Libunao Agency. I am a licensed agent with 4 years of experience specializing in Auto, Home, and Life Insurance. In my free time, I enjoy relaxing at home with my fiancé and taking trips out of town to visit our families. When I'm not assisting our valued customers at our office, I am probably out walking my dog around Carmel! Visit our insurance office today for a free quote. I'm here to help you find the right coverage!

Viewing team member 3 of 11

Meredith Simpson

Office Manager

License #3897784

Hello, I'm Meredith a licensed office manager with one year of experience in property, casualty, life, and health insurance and many years of experience in management and customer service. In my free time, I enjoy traveling anywhere warm, playing chef, and attempting to diy about anything. When I'm not assisting our valued customers at our office, I cherish my family, friends, and anytime I can sneak in a nap. Visit our insurance office today for a free quote. I'm here to help you find the right coverage!

Viewing team member 4 of 11

Gabe Robinson

Account Manager

License #3531953

Hello, I'm Gabe, a licensed account manager with 4 years of experience in home/auto/life/health. In my free time, I enjoy traveling, working out and watching sports. When I'm not assisting our valued customers at our office, I cherish [spending quality time with my family and friends]. Visit our insurance office today for a free quote. I'm here to help you find the right coverage!

Viewing team member 5 of 11

Brittany Harrison

License #4070130

Viewing team member 6 of 11

Travon Ternoir

License #4128608

Viewing team member 7 of 11

Faisal Akbar

License #4166467

Viewing team member 8 of 11

Adam Kirsch

License #4176805

Viewing team member 9 of 11

Luis Velasquez

License #3876854

Viewing team member 10 of 11

Ryan Sagstetter

License #3960841

Viewing team member 11 of 11

Shanna Dahlman

License #3890217

Fishers - IN Full Time

Fishers - IN Full Time

Fishers - IN Full Time

Fishers - IN Full Time

Indianapolis, IN Full Time

Fishers - IN Full Time

Fishers - IN Full Time